Australia’s wage growth has slowed to 3.2% over the past year, marking the slowest quarterly growth since March 2022. According to data released by the Australian Bureau of Statistics (ABS) on Wednesday, wages increased by just 0.7% in the December quarter, down from 0.9% in the previous quarter. This slowdown aligns with the Reserve Bank of Australia’s (RBA) expectations.

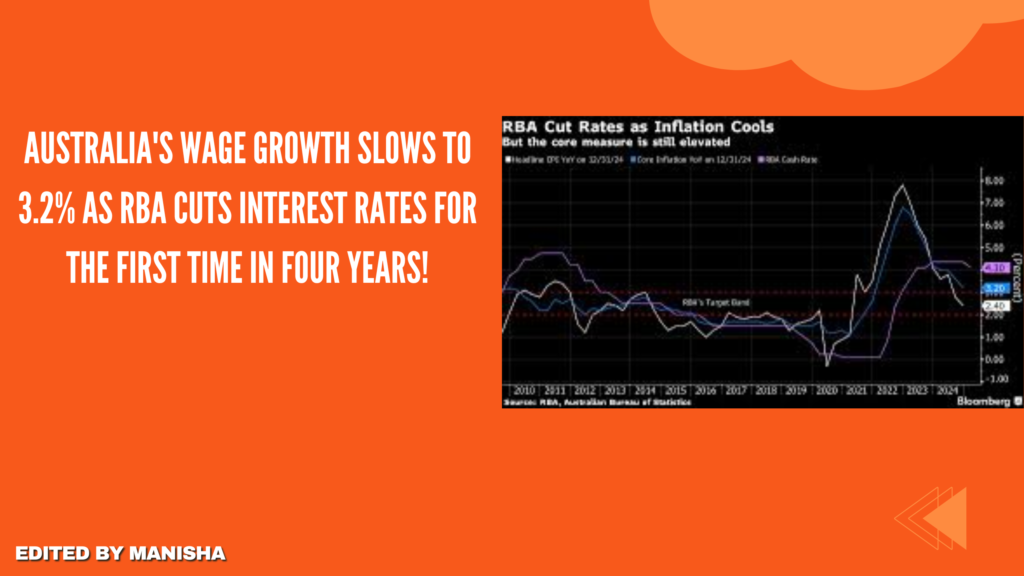

This data comes just a day after the RBA made its first interest rate cut in over four years, lowering the cash rate by 0.25 percentage points, from 4.35% to 4.1%. The central bank cited sufficient evidence of slowing inflation to justify the reduction. Michelle Marquardt, head of prices statistics at the ABS, noted that the decrease in wage growth during the last three months of 2024 was particularly evident. The annual growth in wages for December was 3.2%, down from 4.2% in the same period in 2023, marking the lowest growth since September 2022.

The public sector also saw a notable deceleration in wage growth. Public sector wages grew by only 2.8% annually in the December quarter, down from 3.7% in the September quarter. This means public sector wages are growing at a slower rate than those in the private sector, which grew by 3.3%. Over the past 15 quarters, public sector wages have lagged behind private sector growth in 13 of them, a shift from the pre-pandemic trend.

Despite these trends, the private sector continues to contribute most to the overall wage growth, given the greater number of employees and wage expenditures. However, the public sector’s contribution to total wage growth fell to a quarter in the December quarter, down from 34% a year earlier. This shift was due to the timing of some wage agreements and the expiry of others.

In terms of employment, economists believe the fact that wages are slowing without a loss of jobs suggests the economy could support an even lower unemployment rate than the RBA’s target of 4.5%. With the national unemployment rate at 4%, there’s speculation that Australia could sustain an unemployment rate as low as 3.75% without causing inflationary pressures. Several economists, including those from ANZ, Commonwealth Bank, and Citi, are reconsidering the RBA’s assumption about the Non-Accelerating Inflation Rate of Unemployment (NAIRU), with some suggesting it could be lower than 4.5%. However, others remain skeptical.

RBA Governor Michele Bullock, in her press conference, expressed caution about defining “full employment” with a specific number, describing it as a “very nebulous concept.” She emphasized that Australia’s current labor market, with low underemployment, high participation rates, and numerous job vacancies, suggests a healthy economy. The RBA remains open to the possibility that inflation can continue to fall while maintaining strong employment.

While the RBA cut interest rates, it cautioned that further rate cuts are not guaranteed. The central bank emphasized that it will monitor the labor market and inflation trends carefully before making any further decisions.